BTG banking

- Client BTG Pactual

- Year 2020 - 2022

- Role Product Designer Lead • Associate Director

BTG Pactual, an investment bank, announces BTG+, a fully cloud-based digital bank focused on retail customers. Entry into the retail banking sector is part of a strategy that began with BTG Digital and aims to have 50% of the bank’s revenue coming from retail by 2025.

Note:

This case is not just about individual drafting and UI design; it involves much more, including design strategy, team management, design operation and design leadership. We had an incredible team of talented people working on these ideas, as well as a design studio in a collaborative production (BTG Pactual Design Team + consulting Work&Co). Let me share a little about my experience and the incredible results we have achieved in Product Design.

Creating a retail bank from scratch: A transformation path guided by contemporary user experience for financial systems

Concept Design, Co-Creation, Team Building, and Design Flow: An Inclusive Journey towards UX Maturity.

Creating a bank from scratch

As part of our global strategy, we are dedicated to introducing financial products in a completely innovative and unique manner. In Brazil, as in many parts of the world, we operate within a highly competitive environment where the value proposition extends beyond the product itself. Here, customer choices are driven by exceptional experiences.

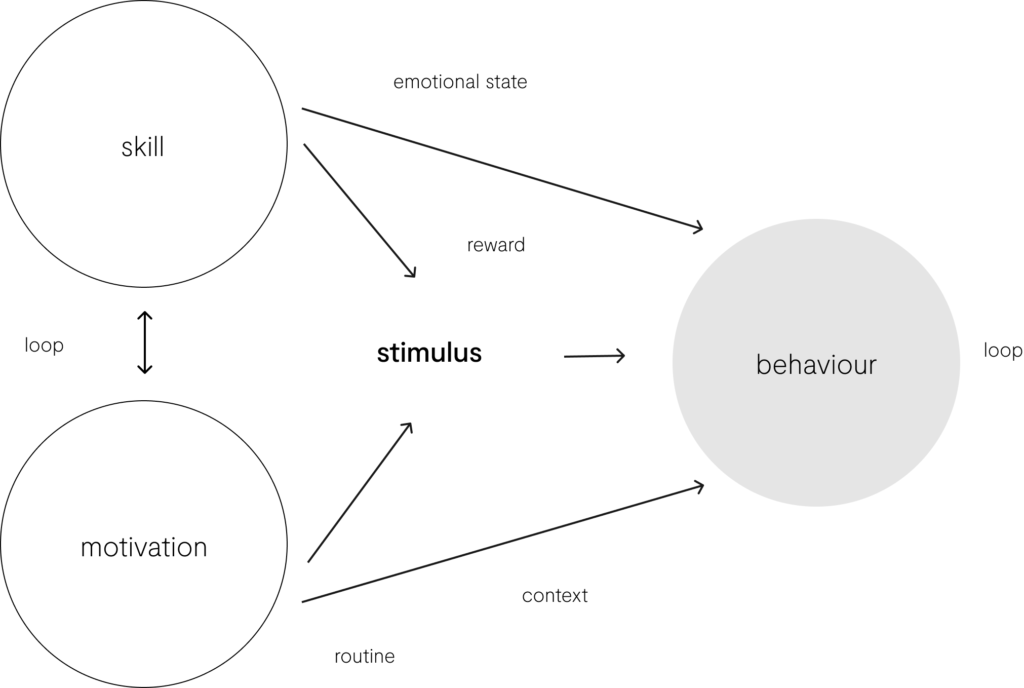

As we take a macro view, our process was fortified by two essential pillars of the design process:

Design concept

Exploration of visual models that help the involved parties channel ideas, test trends, and translate visions. In the process, it is a way to transform concepts into tangible artifacts that explain abstract aspects of the experience. This process was supported by a design studio consulting.

Design detailed

Based on the guidelines, application details are designed through user flows, user stories, interaction design, and prototypes that are tested and adjusted before the handover to BTG developer team. A package plan is created to specify and organize the deliverables.

Concept

The culmination of a meticulously crafted model, driven by a deep understanding of user needs and aligned with emerging trends. Every decision and articulation rooted in user behavior, strategically positioning design as a driving force behind the bank’s transformative initiatives. Part of branding ideia were developed by consulting in NY and improved by the internal design team.

© All rights are reserved

Product experience framing

What do we envision for our product?

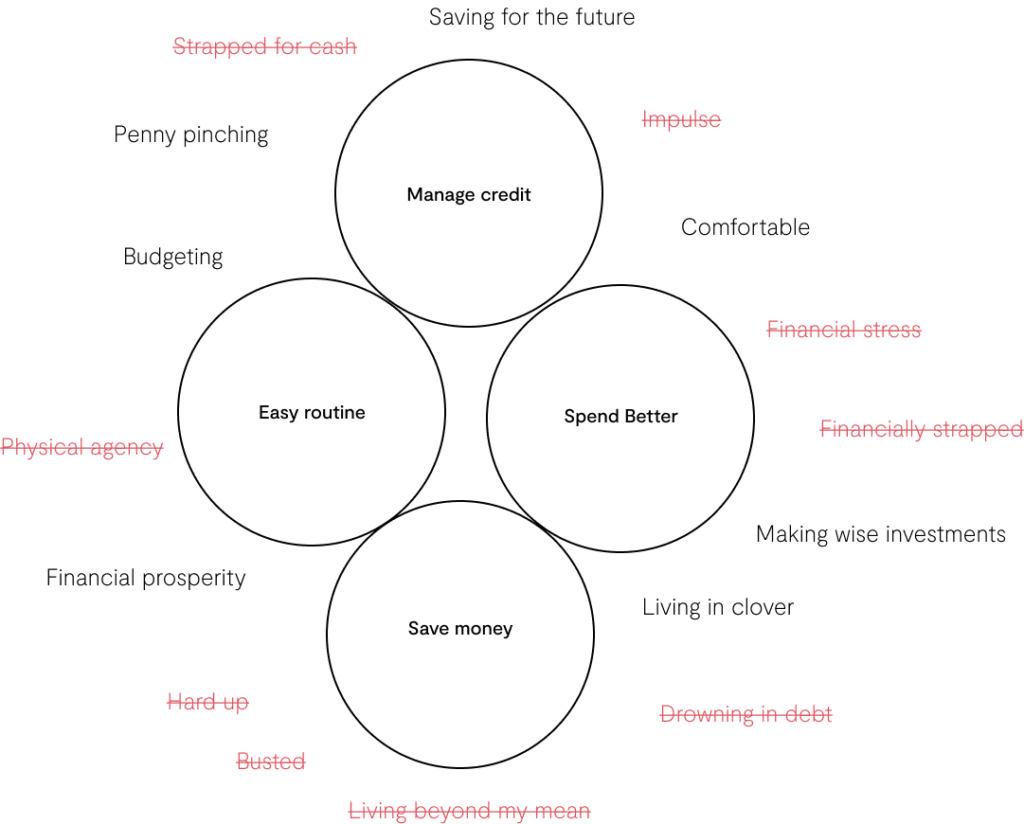

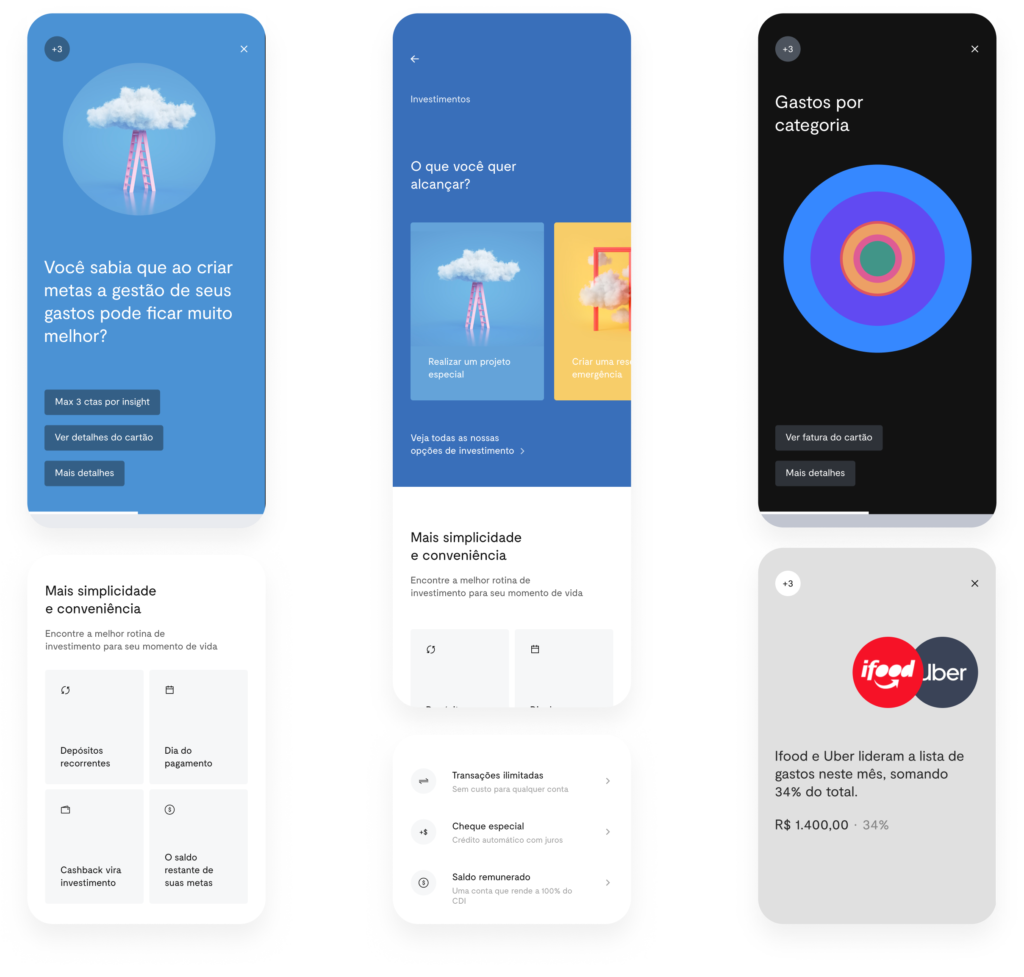

PFM

To foster engagement based on learning, without intruding on privacy or appearing to interfere with dynamics undesired by the customer. Ensuring contextual relevance in all interactions.

Social

To empower individuals by incorporating and reinforcing the social connections related to their finances, fostering a sense of community and support in their financial journey to make their money work harder.

Invisible

To foster engagement based on learning, without intruding on privacy or appearing to interfere with dynamics undesired by the customer. Ensuring contextual relevance in all interactions.

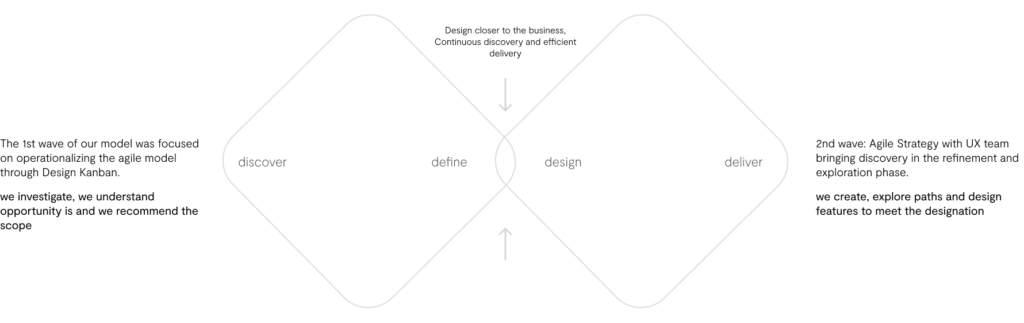

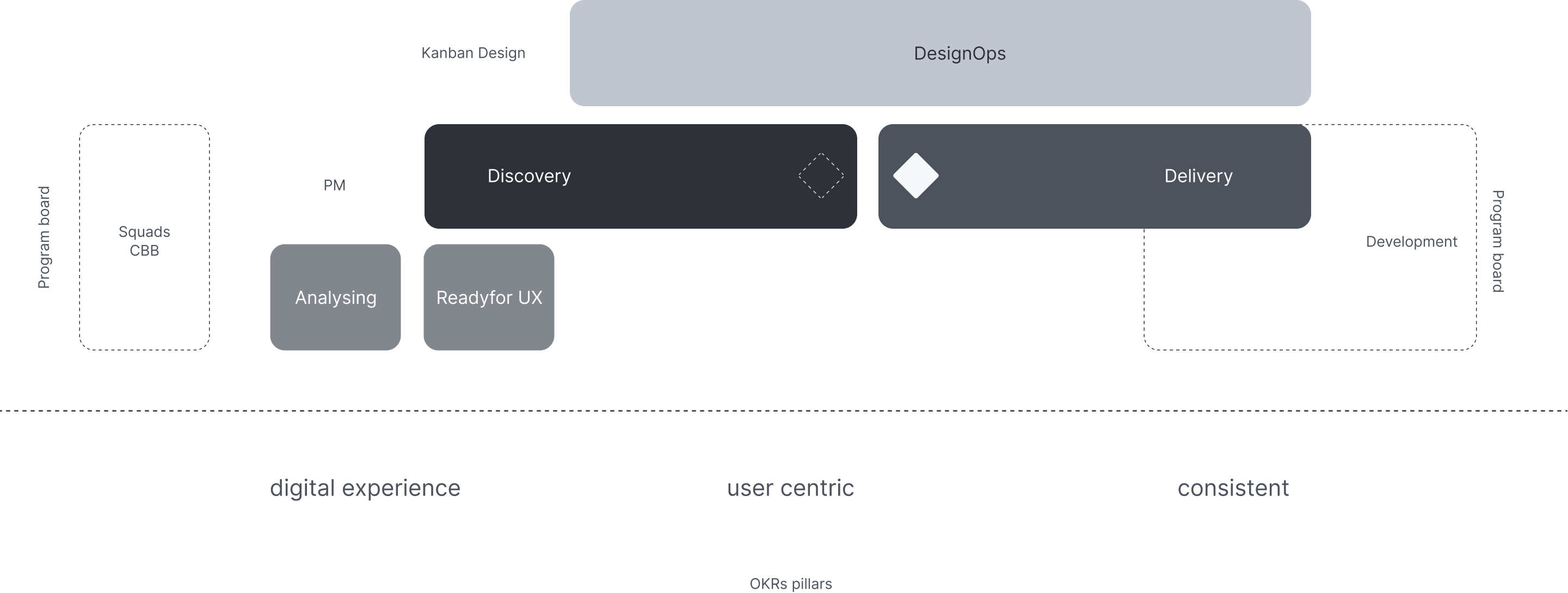

Design flow

Detailed design flow serves as the tactical execution phase of our work, focusing on making designers’ ideas viable and, ultimately, profitable. To ensure user-centric decisions, we have narrowed down the level of exploration in order to validate our hypotheses effectively.

Design team flow

With the product ready (open sea), we move on to the design operation, following an agile model. This involves feedback loops, data collection, iterations, increments, improvements, and debt adjustments. Everything is based on learning and, most importantly, continuous value delivery.

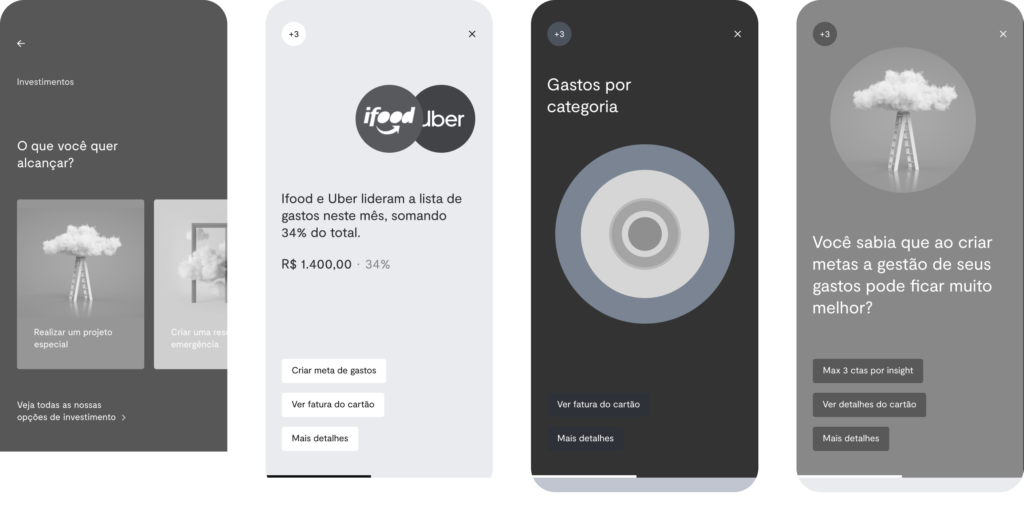

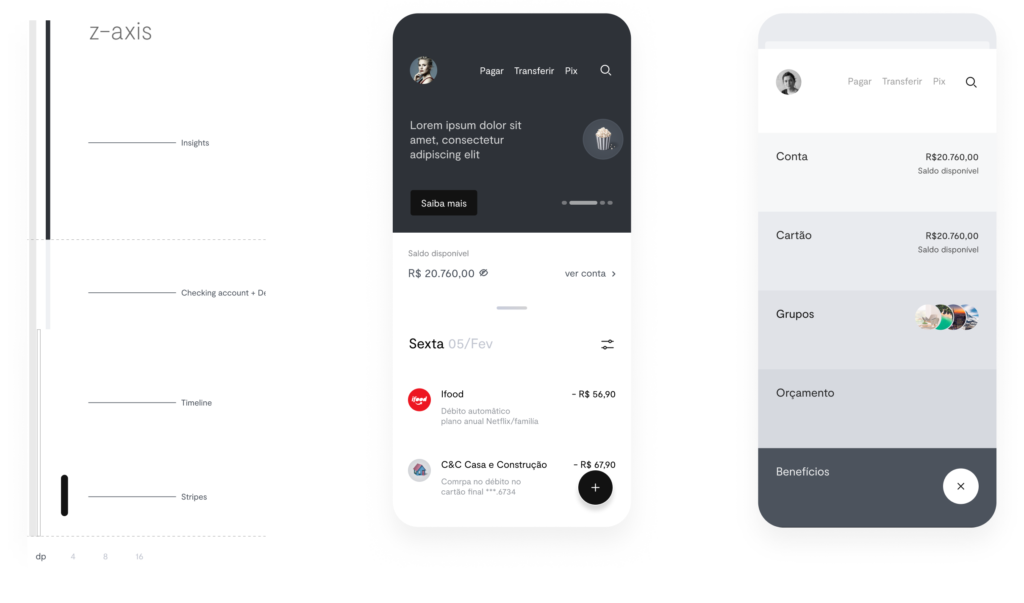

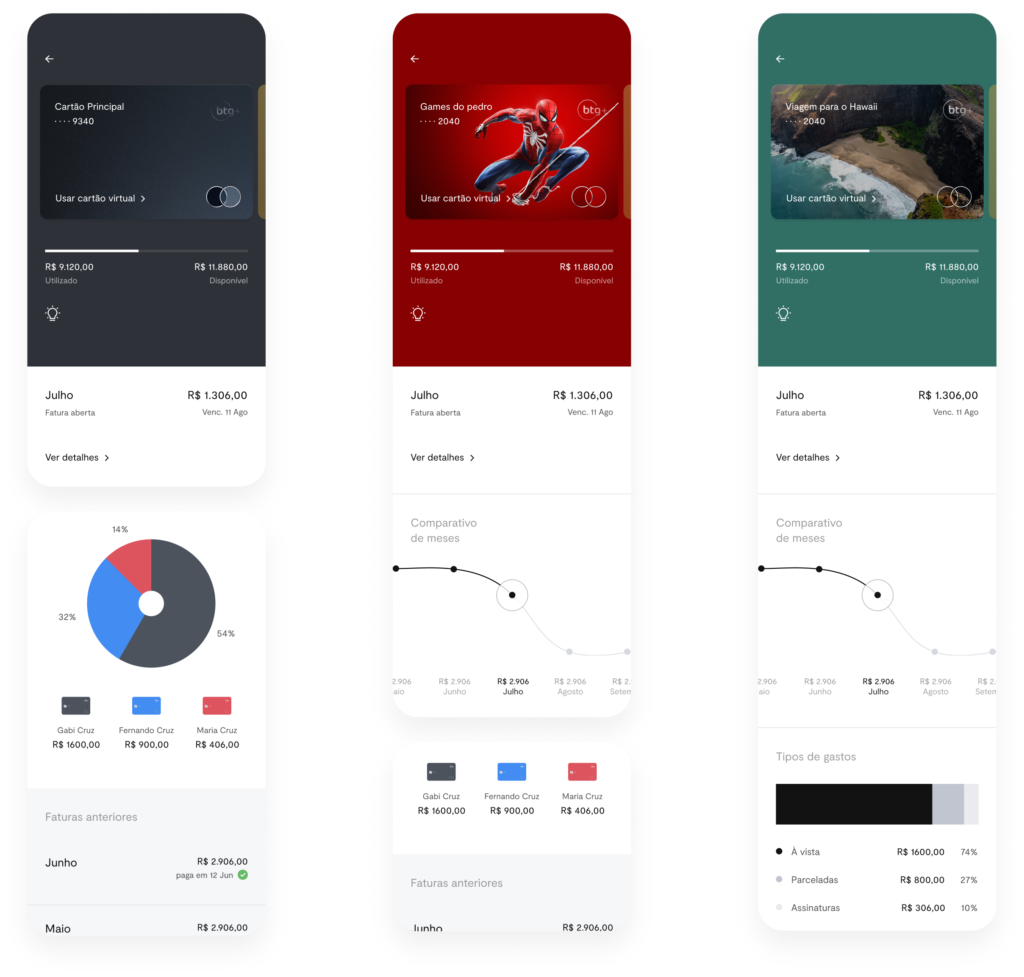

UI Anatomy and Visual examples

As designers, we take great pleasure in witnessing the final outcome in the hands of the users. Below, I present some examples (which have been modified for demonstration purposes). Enjoy it!

The concept of flat and minimalist design has evolved due to user preferences. The introduction of the Z-axis has been employed to enhance the usability of floating menu buttons. Although this deviates from the original design intent, it has become a necessary adaptation to meet user needs effectively.

Design overview

Embrace the disposition of being discreet, social, and empowering in assisting customers with their financial well-being. A bank should transcend the realm of boredom. Don’t you agree? BTG customers certainly do…

Achievements

This is about value, numbers and culture…

Business

Embracing a new business idea requires courage and a bold stance against false beliefs. BTG has certainly exemplified this approach. While perfection is not guaranteed, the resounding response from the bank’s millions of users speaks volumes. With a remarkable 4.9 rating in the Apple Store, BTG has held the position of the highest-rated Brazilian digital bank for over two years.

Product vision

A product vision, although somewhat intangible, requires effort beyond the subjective realm. Nearly 300 professionals who have been involved in creating and using this product are well aware of this fact. It is important to acknowledge that such a vision is not developed overnight.

Design and culture

Our design team, which initially comprised three individuals, has thrived for nearly three years based on an agile and highly productive model. With over ten dedicated professionals involved, we have achieved almost zero turnover. Entrust your product to passionate individuals who will diligently care for it, and revel in the remarkable results.